Agrochemicals and automotive supports growth in Asia

Chemicals production in Japan rebounded in Q3 of 2022. This has been driven, in particular, by the post-recession boom in consumer chemicals (domestic soaps and detergents) and growth in the automotive segment (thanks to an easing in the global chip shortage). Automotive growth has likewise been important for China, although the country’s chemicals industry as a whole has experienced liquidity and supply chain issues caused by the ongoing regional lockdowns that form part of China’s zero-Covid policy. Despite these challenges, China’s agrochemicals industry is expanding, with the country building on its position as a global key producer and export centre for agrochemicals.

Energy transition presents cost and energy security challenges

The global energy crisis is leading to increased production costs across the chemicals industry, especially in the sub-sectors that rely on energy intensive production techniques. Some European governments have introduced business energy support schemes which range from price caps, such as the six-month cap in the UK, to fiscal support schemes such as those seen in France, Germany, the Netherlands and Spain.

Looking further ahead, energy transition is likely to be an item on most boardroom agendas as the industry navigates requirements to transition to clean energy sources. For many chemicals producers this will represent significant capital expenditure, although there will also be a growth in sales opportunities, particularly for those supplying materials for the clean energy sector, such as solar.

ESG issues are also likely to become more important for the industry as both consumers and B2B customers increasingly demand environmental credentials. ESG performance is expected to be bench-marked as highly as cost and other productivity metrics.

Overview of global chemicals industry

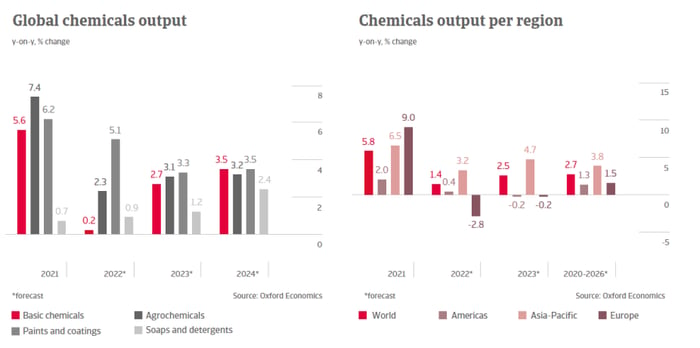

The downturn in the global economy will continue to affect chemicals businesses throughout the world. Stubbornly high inflation, higher interest rates and lower economic growth will negatively affect demand for chemicals in the coming months. Producers in the US are expected to outperform the rest of the world.

An overview of the world chemicals’ markets is available in the November 2022 issue of the Atradius Chemicals Industry Trends Report. The report uses weather forecast icons to provide an at-a-glance view of the economic outlook for major chemicals markets, in addition to the industry performance in several countries including China, France, Germany, Italy, Japan, the Netherlands and the US.