More than half of businesses polled anticipate a gradual recovery of demand

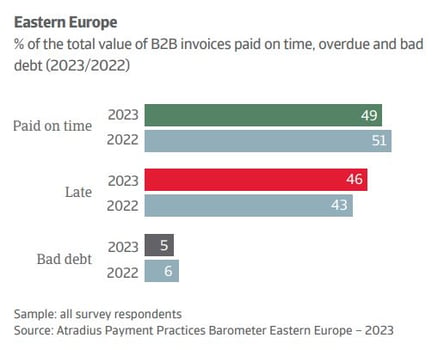

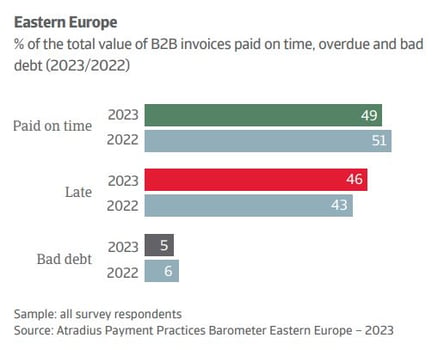

Although respondents to the 2022-2023 Atradius Payments Practices Barometer Survey for Eastern Europe shared their concerns about persistent inflation, most expressed a cautious optimism for improvements in payment practices. This was most clearly evident in the survey results for Days Sales Outstanding (DSO), where almost four in five businesses told us they anticipated improvement or at least no year-on-year deterioration. The average total value of B2B invoices written off also improved from 6% in 2022 to 5% in 2023.

The Atradius Payments Practices Barometer Survey for Eastern Europe is an annual poll of business sentiment. It gives us the opportunity to talk to businesses about their customers’ payment behaviour and allows us to take the temperature of trade across a region, both for businesses that use credit insurance and those that do not.

Encouragingly, when asked to look ahead to next year, more than half of the businesses we spoke to in Eastern Europe said they expect to see a recovery in demand.

What are the challenges facing businesses in Eastern Europe?

Late payments and bad debts continue to present a challenge to businesses in Eastern Europe. However, although a year-on-year increase was reported, both the increase and the total value of B2B invoices paid late are less than that reported by businesses in Western Europe. 46% of invoices were paid late this year in Eastern Europe, compared to 49% late in Western Europe.

Inflation, followed by energy costs and consumer demand, were reported to be the biggest challenges facing businesses in the region over the next 12 months. Different markets also revealed individual challenges. Businesses in Poland, for example, shared concerns about pressures on the local labour market.

What are the key takeaways from the Payment Practices Barometer Survey?

Trade credit as a source of finance

Nearly half of the businesses polled told us they used trade credit as a source of financing. This makes sense as trade credit is an inexpensive way of gaining access to short-term finance, amid the high interest rates imposed by central banks as they try to bring down inflation.

The ability to offer credit to customers and prospects can help businesses gain a competitive edge, especially when other forms of financing can be expensive amid high interest rates.

However, offering trade credit does carry the risk of late or even non-payment. To minimise this risk, a substantial proportion of businesses in the region reported using trade credit insurance to protect their accounts receivable.

Increased appetite for credit insurance

It seems that businesses that used credit insurance in the past continued to do so last year. Looking ahead, 20% more companies than last year told us they would consider taking up credit insurance during the coming 12 months. This could be a reflection of a changing risk environment, as well as a possible signal that businesses in the region are seeking opportunities for a secure growth.

Businesses in Eastern Europe remain cautiously optimistic

Although 85% of businesses in the region expect sales to improve or stay the same over the next 12 months, 25% of those polled expect their customers’ payment practices to deteriorate over the same period. This also reflects the conversations I have been having with businesses in both Central and Eastern Europe. While most large enterprises can absorb late payments from their smaller customers, having a greater understanding of the landscape is certainly helpful.

Download the Atradius Payment Practices Barometer: Eastern Europe report here

.jpg?width=1334&name=charles_bridge_prague_desat_3c_hr%20(2).jpg)